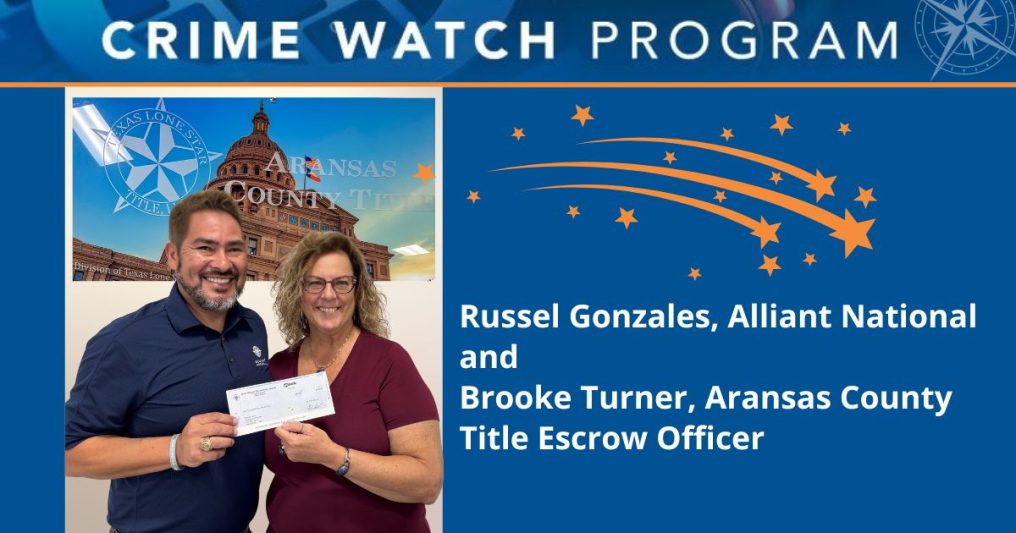

Aransas County Title recently stopped a fraudster cold and became the latest ���dzԹϺ��� Crime Watch recipient By Adam Mohrbacher In the title industry, transaction security can never be secondary. When critical details are overlooked or due diligence is skipped, there can be real consequences for real people. It is for those reasons and more that ���dzԹϺ��� created its …

Eagle-Eyed Title Pro Spots Fraud And Takes Action

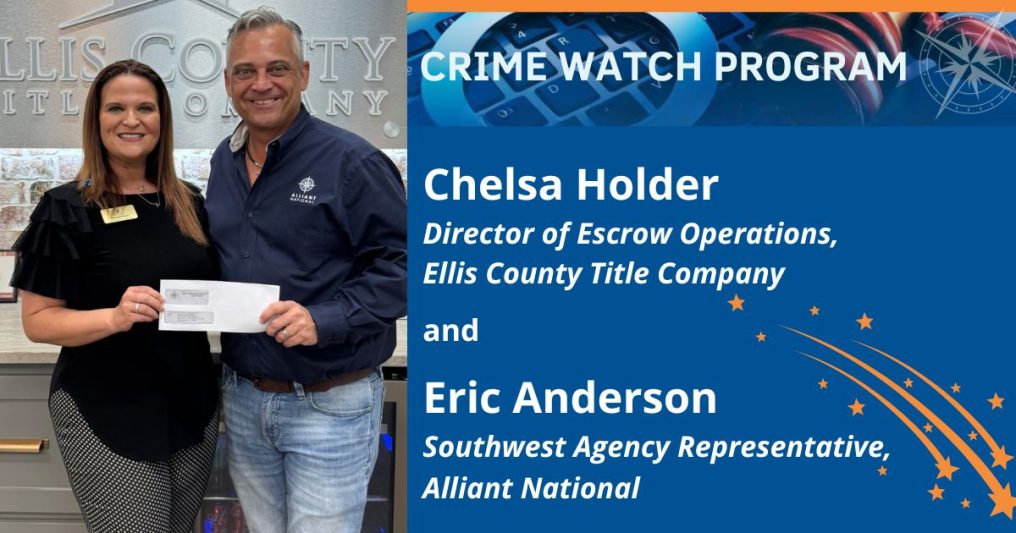

Here’s how Ellis County Title became ���dzԹϺ���’s latest Crime Watch award winner For Chelsa Holder, Director of Escrow Operations for Ellis County Title Company, something felt “off.” The seasoned title professional was working with a seller’s son on a transaction. The son had submitted a Power of Attorney (POA) to authorize the property’s sale. His pushy behavior, however, had …

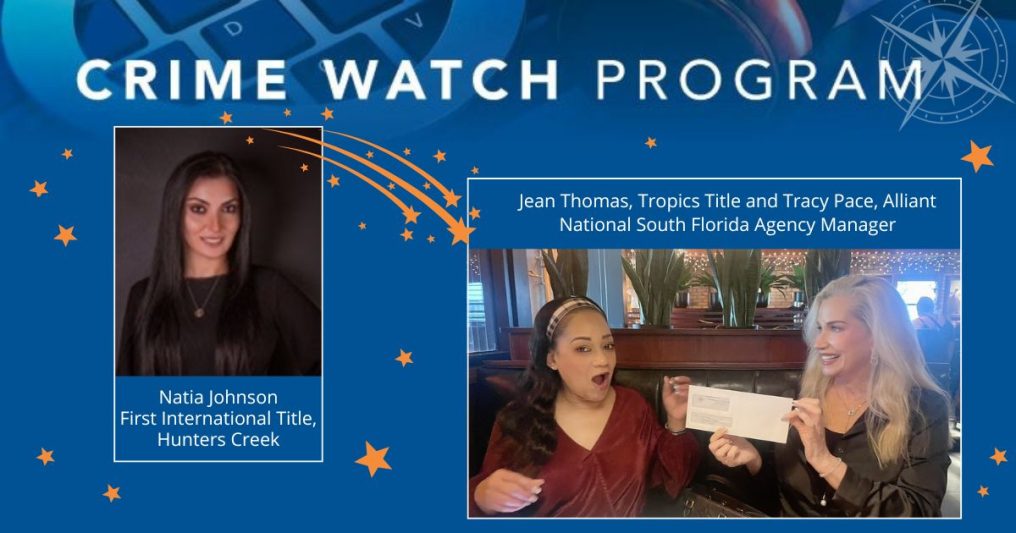

Two ���dzԹϺ��� Agents Take the Fight To Fraudsters

���dzԹϺ��� agents are proving to be a valuable vanguard against real estate crime Although 2025 is barely a quarter old, independent agents have already been hard at work detecting, deterring and preventing fraudulent activity. At ���dzԹϺ���, we’re proud to support these anti-fraud efforts through our Crime Watch program, which incentivizes agents with $1,000 rewards to be extra vigilant …

���dzԹϺ��� Agents Make Sure Crime Doesn’t Pay

We’re honoring agents who played a critical role in safeguarding buyers and sellers throughout 2024. It is famously said that “crime doesn’t pay.” Unfortunately, in the digital age, the opposite is often true. Fraud is a major problem in our industry, and a sad reality that many title agencies have to deal with. Yet a lot can be done to …