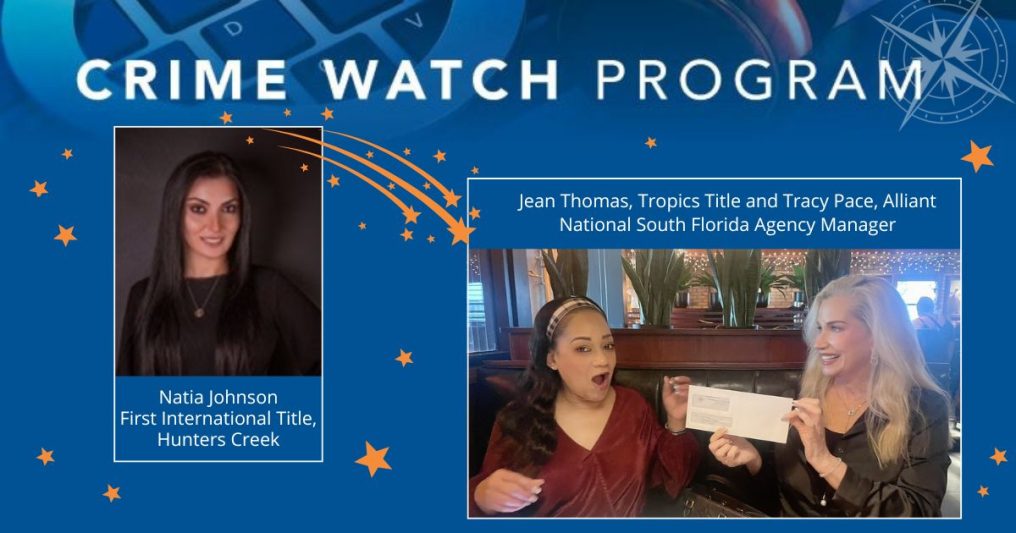

���dzԹϺ��� agents are proving to be a valuable vanguard against real estate crime Although 2025 is barely a quarter old, independent agents have already been hard at work detecting, deterring and preventing fraudulent activity. At ���dzԹϺ���, we’re proud to support these anti-fraud efforts through our Crime Watch program, which incentivizes agents with $1,000 rewards to be extra vigilant …

FinCEN’s Final Anti-Money Laundering Rule For Real Estate Reporting

The buzz is in the air with more questions than answers. FinCEN published its Final Anti-Money Laundering Regulations for Residential Real Estate Transfers on August 28, 2024 (“Final Rule”), throwing the entire real estate industry into a state of high anxiety. What does it all mean? How do we meet its requirements? Will the expense of compliance be a financial …

Beyond GTOs: FinCEN Proposes Expansion Of Industry Reporting Requirements

The U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) issued a Notice of Proposed Rulemaking (NPRM) on Feb. 7 to expand its efforts on a permanent basis to combat and deter money laundering through the residential real estate sector. According to the FinCEN announcement, the proposed rule would require professionals involved in real estate closings and settlements to report information …

Optimizing Opportunity at the Closing Table

Showcase your firm’s strengths at the closing table. Many title agents spend money and time on marketing and sales efforts to increase directable business. While most campaigns are effective, and certainly essential, one of the best opportunities to showcase your firm’s strengths is at the closing table. A well thought-out and unique closing table strategy will result in increased referral …

Flagging Fraud (Part 1): Know These Indicators of Transaction Fraud

Every year the U.S. government comes out with a growing list of warnings on cyber fraud, real estate fraud, email fraud – the list goes on. Some warnings are common sense: delete suspicious-looking emails, don’t give away banking information or social security numbers, never wire anyone money without triple checking – and then checking again. We’re committed to ensuring that …

Don’t Even Hover Your Cursor Over an Unknown Link if You Want to Stay Safe from Wire Fraud

The title and settlement industry is blessed with great people, and that makes sense because our industry is built on being helpful. We all want a smooth, efficient transaction for everyone involved. Unfortunately, our desire to be helpful and to keep things moving makes us a prime target for wire fraud. So, how careful do we need to be when …

Escrow Fraud Remains Low Risk, High Reward

Several months ago, title agents across the country observed an uptick in attempted escrow fraud. In many cases, fraudsters posed as other participants in the transaction and attempted to trick agents into wiring funds to fraudulent accounts. The vast bulk of these escrow fraud attempts involved bogus emails. The stories and dollar losses were startling, and the industry responded. Alliant …